July 27

The Florida Local Government Investment Trust (Florida Trust) is excited to announce a “Lunch and Learn” session with Beth Westvold from Payden & Rygel. Join the Florida Trust on Tuesday, July 30, 2024, at 12:00pm EST for a one-hour virtual session on "Positioning Cash & Reserve Cash Assets for Future Fed Rate Cuts"

Click here to register!

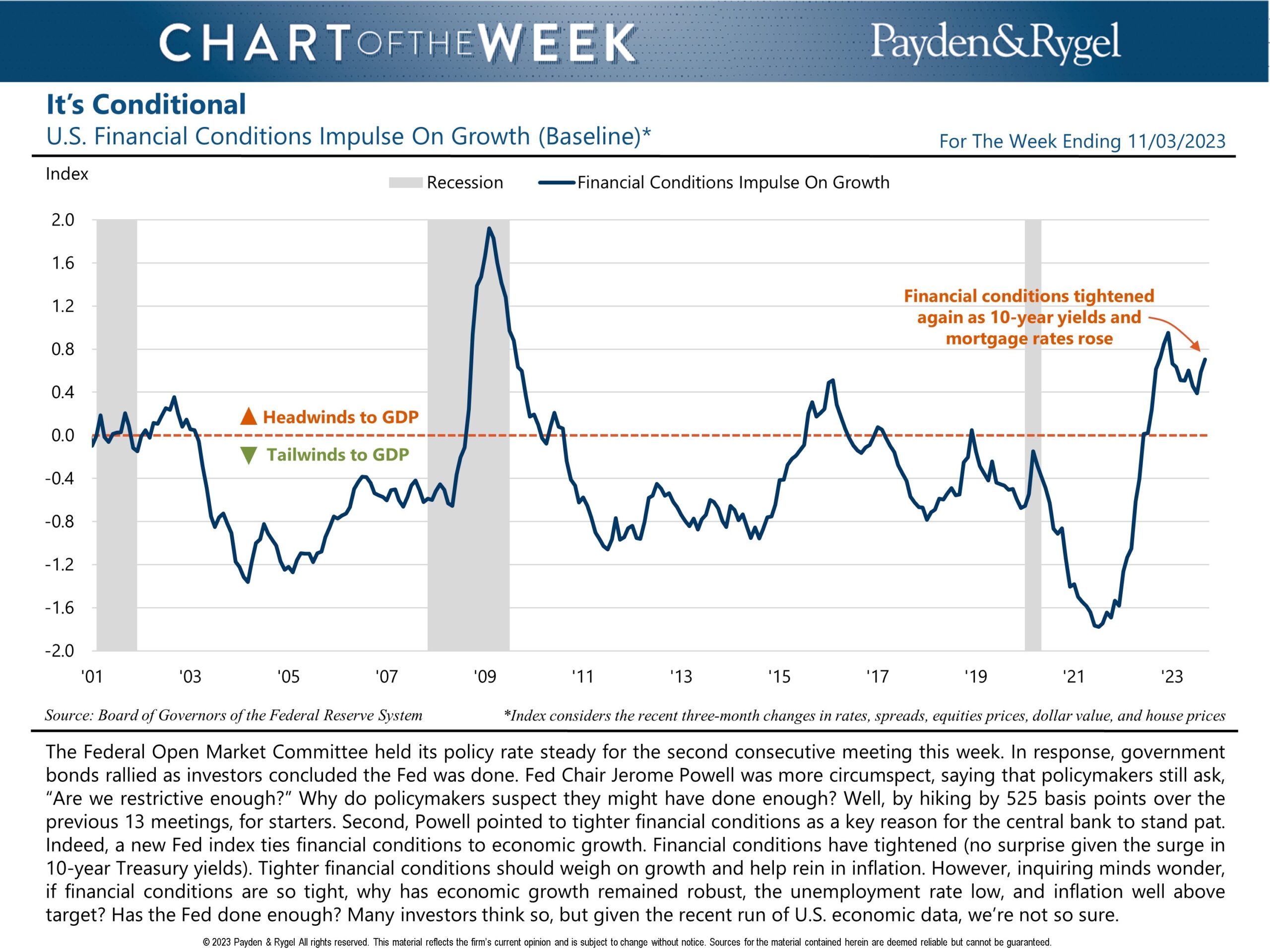

Jeffrey Cleveland, Chief Economist on inflation prospects - Hope is not a strategy. Click below for more.

Hope is not a strategy: Click Here.

Funds professionally managed by Payden & Rygel for 29 years running.

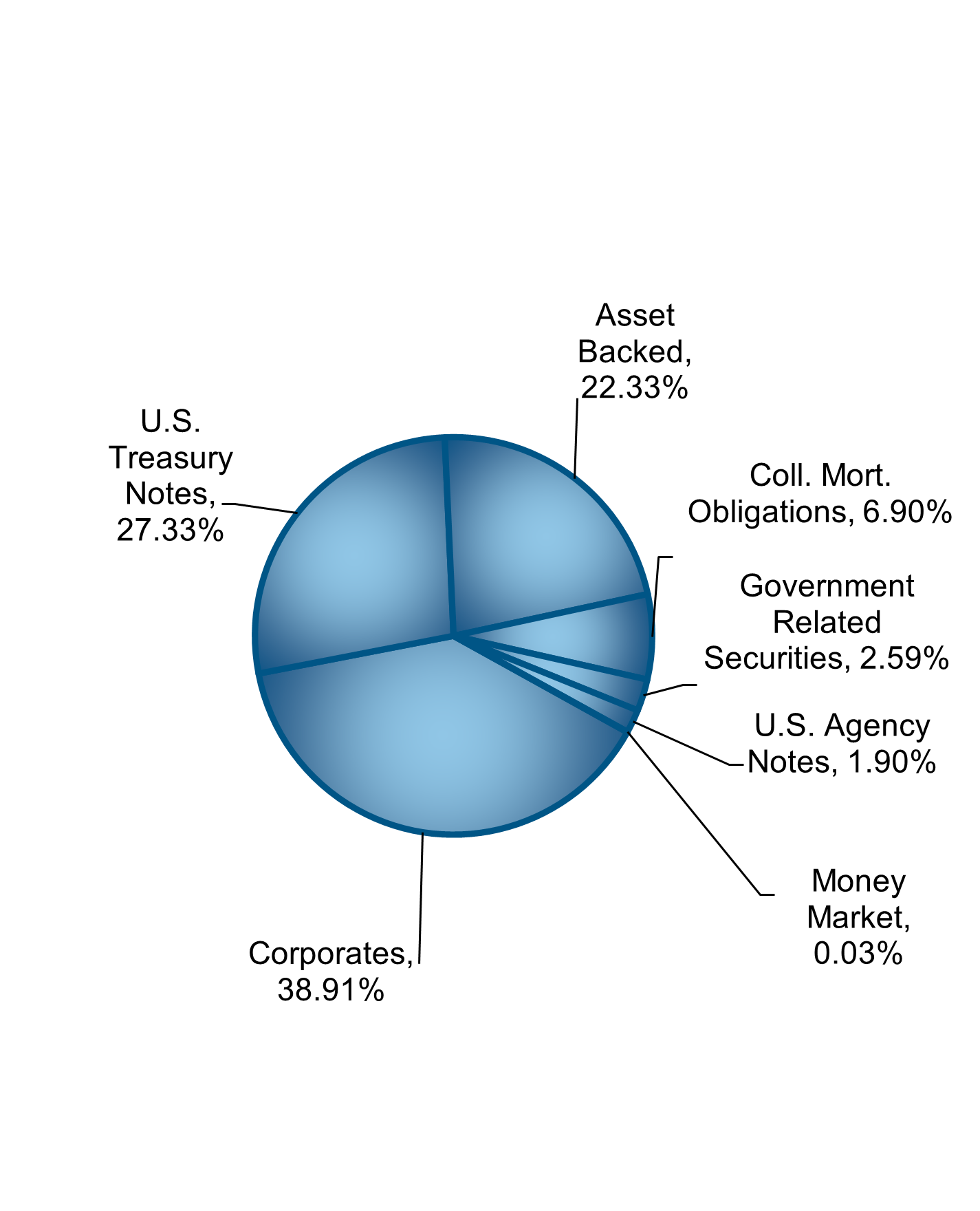

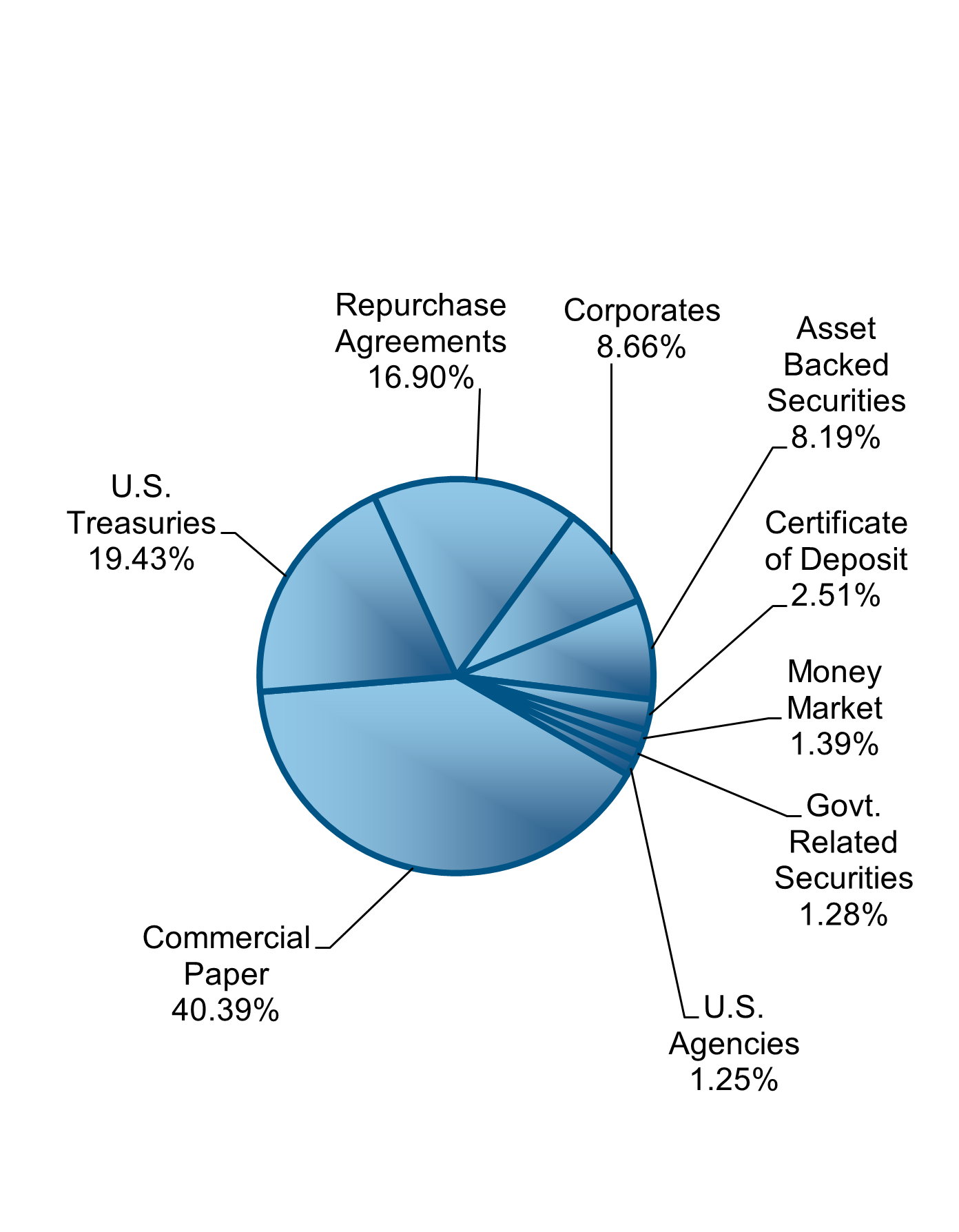

Sector Allocation

% of Portfolio Assets(12/31/23)

Your Investment

How has your investment grown over time?